Trader’s Guide 1.4- Institutions

Financial institutions are organizations that offer financial products and services to individuals, businesses, and governments. These products and services can include loans, investments, insurance, and more. There are several different types of financial institutions, each with their own unique features and offerings.

Trader’s Guide 1.3- Terminology

The world of investments can be a daunting place, especially for those just starting out. With so many different terms and concepts to wrap your head around, it can be hard to know where to begin. That's why in this chapter, we'll be taking a look at some of the basic vocabulary you'll need to understand the various investment vehicles out there.

Trader’s Guide 1.2- Compound Interest

Have you ever heard the saying, "A penny saved is a penny earned"? Well, when it comes to compound interest, a penny saved can turn into a whole lot more.

Trader’s Guide 1.1- Financial Planning

A financial plan for the average person should generally include the following elements:

A budget: This outlines your income and expenses, and helps you make informed decisions about how to save and spend your money.

A debt repayment plan: If you have any high-interest debts, such as credit card balances or personal loans, your financial plan should include a strategy for paying them off as quickly as possible.

Asset Bubbles

Asset Bubbles - signs of them forming, examples of asset bubbles in history, and signs of them bursting

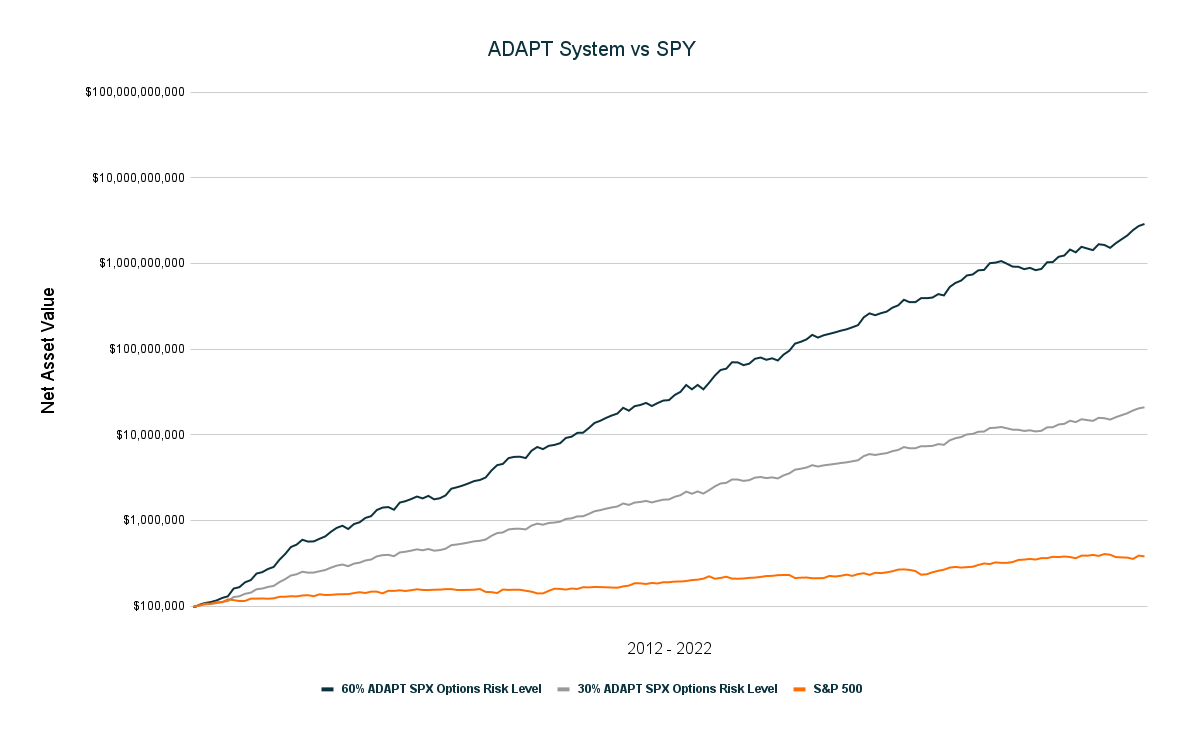

Diversifying for More Return

The common misconception is that diversifying means giving up return. This has been shouted for years at market participants. Well, today is the day that we make diversifying the cool thing to do. The SWP uses six asset classes and selectively allocates them based on the macro-economic environment.

Deleveraging

We are currently going through an early-stage bear market cycle called “deleveraging”. To better explain what is happening right now, it is best to start by explaining the creation of money through debt. The modern way of creating money is through the debt system.

The Rise of ETFs and The Fall of Diversification

In 2021 nearly all investors, retail and institutional use ETFs for their exposure. What they are and how they have changed the way that the markets have behaved for decades, is what we are discussing today.