The Ultimate Guide to Selling Credit Spreads Using SPX Options

Introduction

Selling credit spreads in SPX options is a popular strategy among options traders looking for a balanced approach to risk and reward. SPX options, based on the S&P 500 Index, offer a broad market exposure, making them ideal for traders who prefer index-based trading rather than individual stocks. This guide aims to provide in-depth knowledge on selling credit spreads, covering strategies, risks, benefits, and practical steps to help you become a successful trader.

Understanding Credit Spreads in SPX Options

What Are SPX Options?

SPX options are financial derivatives based on the S&P 500 Index, which tracks the performance of 500 of the largest publicly traded companies in the United States. Unlike options on individual stocks, SPX options are European-style options, meaning they can only be exercised at expiration. This feature makes SPX options particularly suited for strategic trading and hedging. We go into more detail about the benefits of SPX Options trading HERE

What Is a Credit Spread?

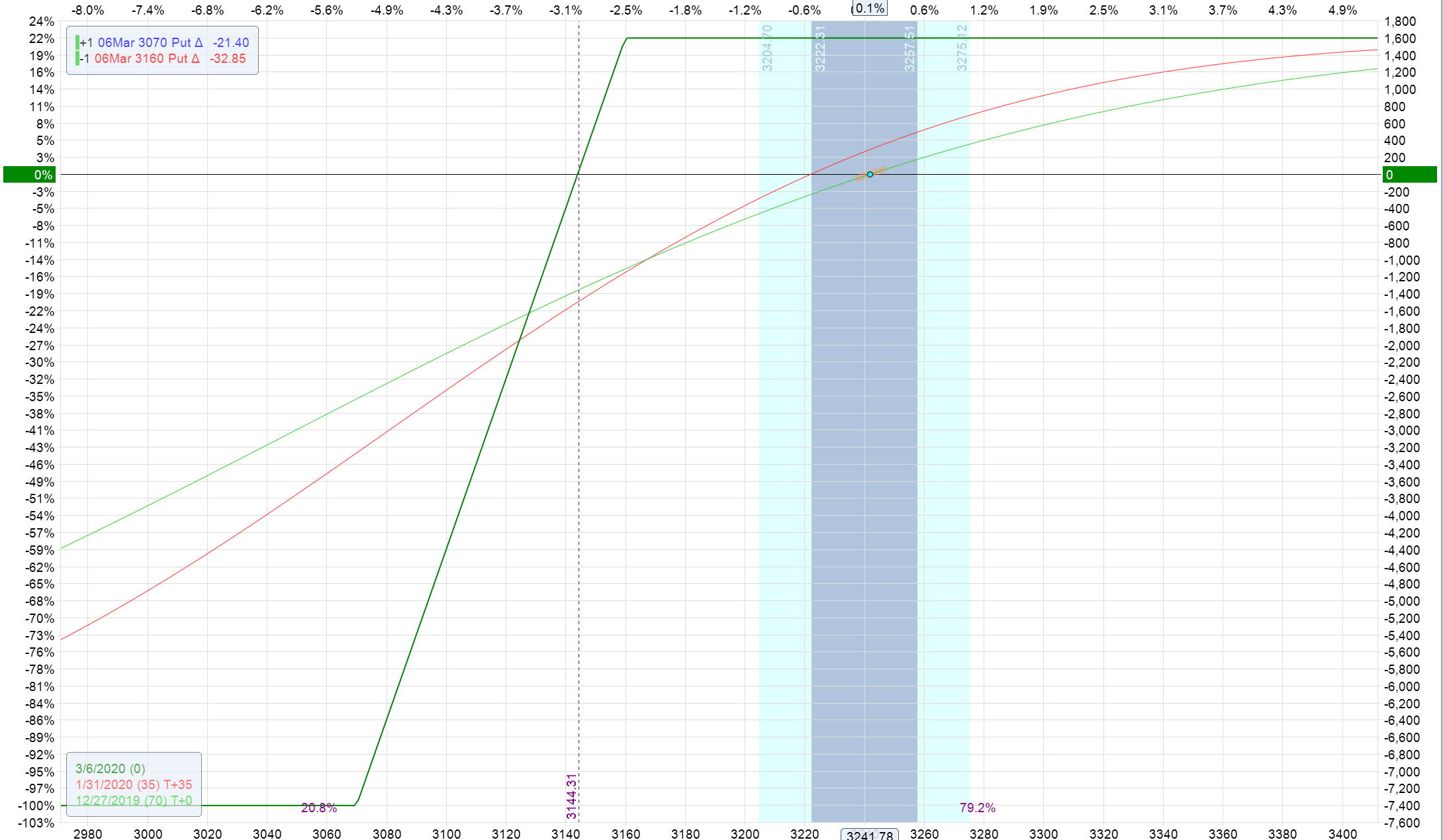

A credit spread is an options strategy where a trader simultaneously buys and sells options of the same class (calls or puts) with different strike prices, resulting in a net credit received. This strategy limits both potential profit and potential loss, making it a risk-defined strategy. There are two main types of credit spreads:

Bull Put Spread (Bullish Credit Spread): Selling a put option at a higher strike price while buying another put option at a lower strike price.

Bear Call Spread (Bearish Credit Spread): Selling a call option at a lower strike price while buying another call option at a higher strike price.

Why Sell Credit Spreads in SPX Options?

Selling credit spreads in SPX options offers several advantages:

Defined Risk: The maximum loss is limited to the difference between the strike prices minus the net credit received.

High Probability of Success: Traders can choose strike prices that are out of the money, increasing the likelihood of the options expiring worthless.

Income Generation: Credit spreads generate income upfront from the premium received.

Flexibility: Traders can adjust or close the position before expiration to manage risk or lock in profits.

Setting Up Your First Credit Spread

Choosing the Right Strategy

The choice between a bullish or bearish credit spread depends on your market outlook:

Bullish Credit Spread: Use a bull put spread when you expect the S&P 500 Index to rise or stay above a certain level. This strategy is ideal during periods of relative volatility spikes in an uptrend.

Bearish Credit Spread: Use a bear call spread when you expect the S&P 500 Index to fall or stay below a certain level. This strategy works well in no trend or downtrends, especially when volatility is at relative lows.

Selecting the Strike Prices

Choosing the appropriate strike prices is crucial for a successful credit spread:

Out-of-the-Money (OTM) Options: Selling OTM options increases the probability of the spread expiring worthless, which is favorable for the trader.

Strike Price Difference: The difference between the strike prices determines the potential profit and loss. A wider spread offers higher potential profit but also higher risk.

Determining the Expiration Date

The expiration date impacts the risk and reward of the credit spread:

Short-Term vs. Long-Term Expirations: Short-term expirations offer quicker returns but are more sensitive to price movements. Long-term expirations provide more time for the trade to work but may involve greater risk due to the time decay factor.

Optimal Expiration Selection: Choose expirations that align with your market outlook and risk tolerance. Many traders prefer monthly expirations for SPX options.

Calculating Potential Profit and Loss

Understanding the potential profit and loss is essential for risk management:

Maximum Profit: The maximum profit is the net credit received when setting up the spread.

Maximum Loss: The maximum loss is the difference between the strike prices minus the net credit received.

Break-Even Point: The break-even point is the strike price of the sold option minus the net credit received for put spreads and plus the net credit received for call spreads.

Maximizing Profit

If you are interested in timing your entries to maximize profit and probability when selling credit spreads, check our “Timing Credit Spreads” article HERE

Step-by-Step Guide to Selling Credit Spreads

Opening a Brokerage Account

To start trading SPX credit spreads, you'll need a brokerage account that supports options trading. Consider the following when choosing a broker:

Options Trading Approval: Ensure the broker provides access to options trading and the necessary approval level for spreads.

Commissions and Fees: Look for competitive commissions and fees to maximize profitability.

Trading Platform: A user-friendly platform with robust tools for options analysis and trading is essential. We like Schwab because of “Think or Swim”

Placing Your First Trade

Follow these steps to place your first credit spread trade:

Log In to Your Trading Platform: Access your brokerage account.

Select SPX Options: Find SPX options under the index options category.

Choose Strike Prices: Select the appropriate strike prices based on your strategy.

Select Expiration Date: Choose an expiration date that aligns with your market outlook.

Enter the Trade: Input the details of the credit spread and review the order.

Confirm the Trade: Submit the order and wait for execution.

Managing Your Position

Effective management of your credit spread position is crucial:

Monitoring the Trade: Keep an eye on the SPX Index and the options' prices. Use alerts to notify you of significant price movements.

Adjusting the Position: If the trade moves against you, consider rolling the spread to a different strike price or expiration date to manage risk.

Taking Profits: Close the trade early if the options have significantly decreased in value, locking in profits.

Closing Your Trade

Closing a credit spread involves reversing the initial trade:

Monitor Expiration: As expiration approaches, decide whether to close the position or let it expire.

Execute the Closing Trade: Enter an order to buy back the sold option and sell the bought option.

Verify the Close: Ensure the trade is executed and the position is closed.

Advanced Strategies and Tips

Adjusting Your Credit Spreads

Adjusting your credit spreads can help mitigate losses or enhance profits:

Rolling the Spread: Move the spread to a different strike price or expiration date to extend the trade's duration.

Adding Positions: In a strong market conviction, consider adding more spreads at different strike prices to increase potential profit.

Hedging Your Positions

Hedging involves using other options to offset potential losses:

Protective Puts: Buy put options to hedge against a decline in the SPX Index.

Protective Calls: Buy call options to hedge against a rise in the SPX Index when holding a bear call spread.

Using Technical Analysis

Technical analysis can enhance your credit spread strategy:

Support and Resistance Levels: Identify key support and resistance levels to choose strike prices.

Moving Averages: Use moving averages to gauge the trend direction and strength.

Volatility Indicators: Monitor indicators like the VIX to assess market volatility.

Opportunistic Times to Sell Credit Spreads

Timing is critical in selling credit spreads:

Bullish Credit Spreads (Bull Verticals): Look for spikes in relative volatility during an uptrend. These are ideal times to sell bull put spreads with tight stops to manage risk.

Bearish Credit Spreads (Bear Verticals): Sell bear call spreads during periods of no trend or downtrends, especially when volatility is at relative lows. This increases the likelihood of the options expiring worthless.

Common Questions About Selling Credit Spreads SPX Options

What Are the Risks Involved?

Understanding the risks is crucial for successful trading:

Market Risk: The primary risk is adverse price movements in the SPX Index.

Volatility Risk: Changes in market volatility can impact the value of the options.

Assignment Risk: Although SPX options are European-style, assignment risk is minimal before expiration but must be considered at expiration.

How Much Capital Is Required?

Capital requirements vary based on the spread width and broker margin requirements:

Minimum Capital: Ensure you have enough capital to cover the maximum potential loss.

Margin Requirements: Brokers may require margin to cover the trade, which varies based on their policies.

What Are the Tax Implications?

Tax considerations are important for options traders:

Capital Gains: Profits from credit spreads are generally considered short-term capital gains.

Reporting: Keep detailed records of your trades for accurate tax reporting.

Can I Sell Credit Spreads in an IRA?

Selling credit spreads in an IRA is possible with certain restrictions:

Broker Approval: Ensure your broker allows options trading in IRAs.

Risk Management: Use defined-risk strategies like credit spreads to comply with IRA trading rules.

Conclusion

Selling credit spreads in SPX options offers a balanced approach to risk and reward, making it a popular strategy among options traders. By understanding the fundamentals, choosing the right strategies, and effectively managing your positions, you can increase your chances of success. Remember to stay informed about market conditions and continuously refine your trading skills.

Additional Resources

Recommended Books

The Options Playbook by Brian Overby

Trading Options Greeks by Dan Passarelli

The Misbehavior of Markets: A Fractal View of Financial by Benoit Mandelbrot

Online Courses and Webinars

Tools and Software

Option Pricing Calculators: Tools to calculate potential profit and loss.

Trading Platforms: Interactive Brokers, Thinkorswim, and Tastyworks.

References

Investopedia - Options Trading

Internal Links

External Links

S&P Dow Jones Indices

By focusing on these key elements, you'll be well-equipped to start trading SPX credit spreads effectively. Happy trading!