Consumer Inflation vs Asset Inflation: How the Federal Reserve is Changing the Game

Understanding the Different Faces of Inflation

Inflation, the general increase in prices of goods and services over time, impacts everyone. It erodes purchasing power, making it harder to afford necessities and maintain living standards. But inflation isn't a monolithic force. It can manifest differently in various sectors of the economy, notably as consumer inflation and asset inflation. This article delves into these distinct types of inflation, examines how the Federal Reserve influences them, and provides insights into navigating these challenging economic times, particularly focusing on how to potentially profit from asset inflation.

Understanding Consumer Inflation

Consumer inflation, measured by the Consumer Price Index (CPI), tracks the average change in prices paid by urban consumers for a basket of consumer goods and services. This basket encompasses everyday essentials like food, housing, transportation, and healthcare. A rise in CPI signifies that the cost of living is increasing, impacting consumers' ability to afford these necessities.

[Include an infographic here illustrating the composition of the CPI basket. Potential sources: Bureau of Labor Statistics (BLS) website, Statista, or create your own using tools like Canva or Piktochart]

For example, if the price of gasoline increases by 20%, consumers with a fixed budget might need to cut back on other expenses to accommodate the higher fuel costs. This reduction in purchasing power can ripple through the economy, affecting businesses and overall consumer confidence.

Understanding Asset Inflation

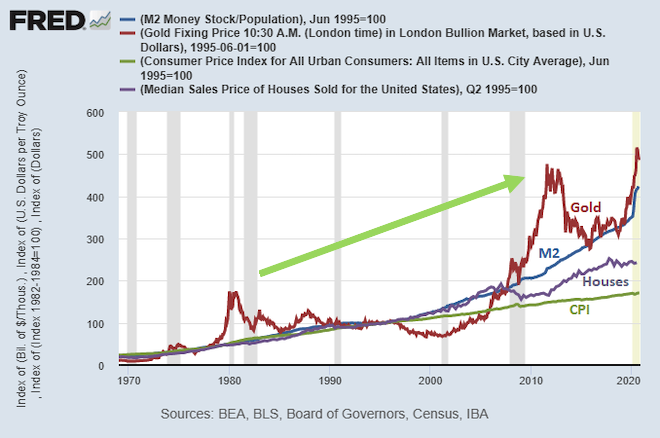

Asset inflation, in contrast, refers to the increase in the prices of assets such as stocks, real estate, commodities (like gold or oil), and even collectibles. Unlike consumer goods that are consumed, assets are held for investment purposes with the expectation of appreciation in value.

Several factors contribute to asset inflation:

Low-interest rates: Lower borrowing costs incentivize investors to take on more debt to purchase assets. This increased demand pushes prices upwards. Imagine a scenario where mortgage rates are exceptionally low; this can lead to a surge in demand for housing, driving up property values.

Increased demand: When demand for an asset outstrips supply, prices naturally rise. This can be fueled by factors like economic growth, population growth, or changes in investor sentiment. For instance, if there's a growing belief that a particular cryptocurrency will become the future of finance, its price could skyrocket due to increased investor demand.

Limited supply: Some assets, like real estate in prime locations, rare artwork, or limited-edition collectibles, have a finite supply. This scarcity can lead to significant price appreciation. Think of a vintage sports car; as fewer remain in good condition, their value increases due to their rarity.

Fear of inflation: When consumers expect higher inflation in the future, they may invest in assets like real estate or commodities seen as "inflation hedges," further driving up their prices.

Profiting from Asset Inflation

While asset inflation presents challenges, it also creates opportunities for savvy investors. Here's how you can potentially profit:

Strategic asset allocation: Carefully select assets that are likely to appreciate in value during inflationary periods. This could include:

Real Estate: Historically, real estate has been considered a good hedge against inflation. As prices rise, so does the value of your property and rental income.

Commodities: Commodities like gold, silver, and oil often rise in price during inflationary periods as investors seek to preserve their capital.

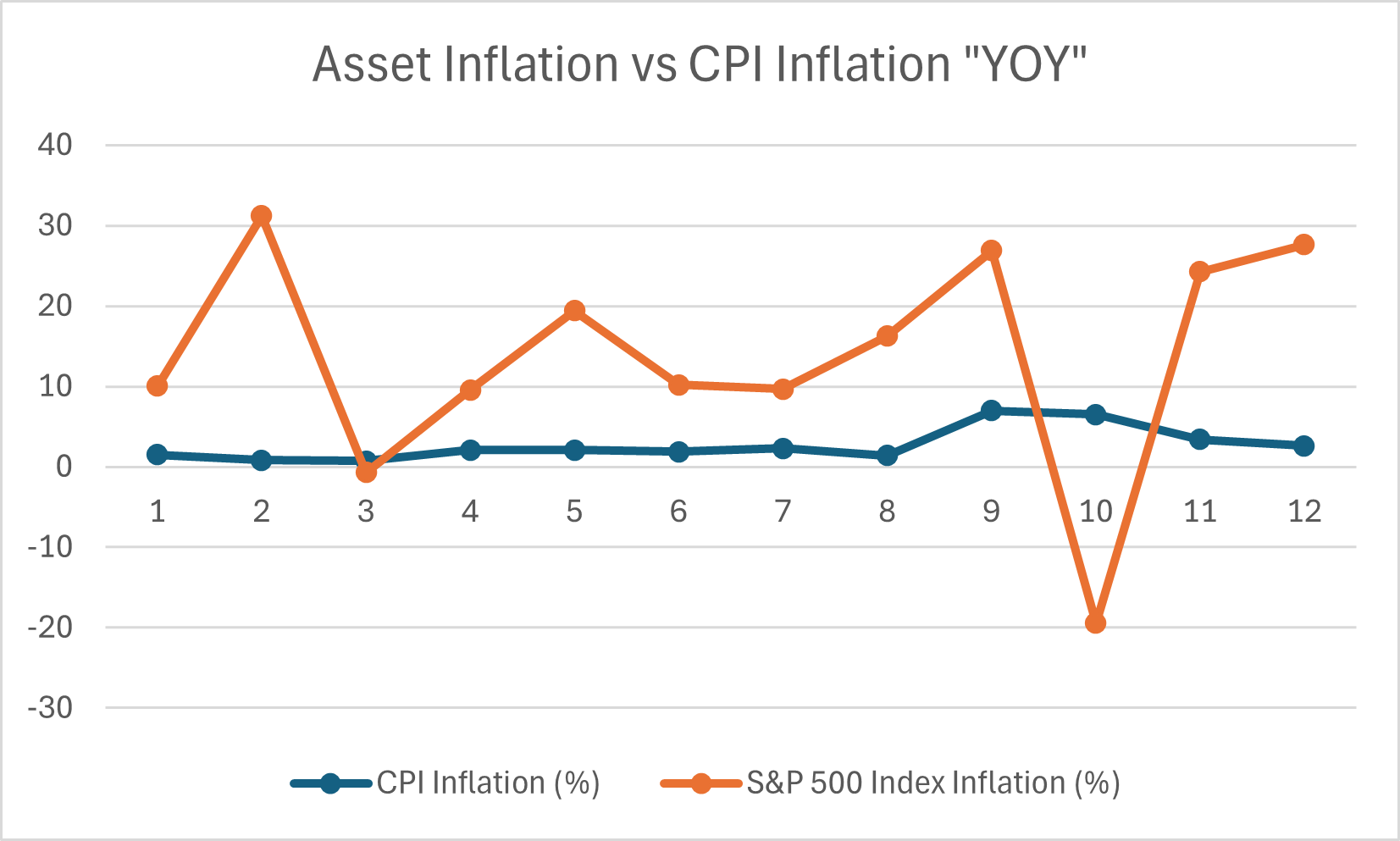

Stocks: While the stock market can be volatile, investing in companies with strong fundamentals and pricing power can offer protection against inflation. These companies can pass on increased costs to consumers, maintaining profitability.

Alternative Investments: Explore options like collectibles (art, rare coins, etc.), which can appreciate significantly in value during inflationary times.

Time the market (with caution): While perfectly timing the market is impossible, understanding economic cycles and identifying potential asset bubbles can help you make informed investment decisions. For example, if you anticipate that interest rates will rise soon, you might consider reducing your exposure to assets that are highly sensitive to interest rate changes, like bonds.

Leverage: Borrowing money to invest can amplify your returns, but it also increases your risk. If you're comfortable with leverage, consider using it strategically to purchase appreciating assets. However, be aware that if asset prices decline, your losses will also be magnified.

The Federal Reserve's Role in Inflation

The Federal Reserve (the Fed), the central bank of the United States, plays a crucial role in managing inflation. Its mandate is to maintain price stability and maximum employment. To achieve this, the Fed employs various monetary policy tools:

Interest rate adjustments: The Fed can raise or lower interest rates to influence borrowing costs and economic activity. Raising rates can cool down inflation by making borrowing more expensive, while lowering rates can stimulate growth.

Reserve requirements: Banks are required to hold a certain percentage of their deposits as reserves. Adjusting these requirements can affect the amount of money available for lending and influence inflation.

Open market operations: The Fed buys or sells government securities in the open market to influence the money supply and credit conditions. By buying securities, the Fed injects money into the economy, while selling securities withdraws money.

The Fed's actions have a significant impact on both consumer and asset inflation. For example, raising interest rates can curb consumer spending, slowing down consumer inflation. It can also make borrowing more expensive for investors, potentially cooling down asset inflation. However, the Fed must carefully balance its inflation-fighting measures with the need to support economic growth and avoid triggering a recession.

Consumer Inflation vs. Asset Inflation: The Current Landscape

In recent years, both consumer and asset inflation have been on the rise. The COVID-19 pandemic, supply chain disruptions, geopolitical tensions (like the war in Ukraine), and government stimulus measures have all contributed to this trend.

[The Consumer Price Index for All Urban Consumers (CPI-U) increased 2.6 percent over the last 12 months to October 2024, indicating a moderate rise in consumer prices]. Similarly, [the S&P 500 index has risen by 26.7% this year, reaching a record high of 6,043.18, reflecting significant asset inflation].These statistics highlight the current economic landscape, where we're seeing both consumer price inflation and asset price appreciation. The CPI increase suggests a steady rise in the cost of goods and services for urban consumers, while the substantial gain in the S&P 500 index points to strong performance in the stock market and potentially increased investor optimism.It's worth noting that [the energy index decreased 4.9% for the 12 months ending October 2024, while the food index increased 2.1% over the same period]. This divergence in price trends across different sectors of the economy adds nuance to the overall inflation picture.In the financial markets, [the Russell 2000® Index saw even stronger performance, rising nearly 11% in November 2024, outpacing the S&P 500's 5.7% gain for the month]. This suggests that smaller, more industrially focused companies have been performing particularly well in the current economic environment.These figures provide a snapshot of the complex interplay between consumer prices, asset values, and various economic sectors in the current financial landscape.

How the Fed is Changing the Game

To combat rising inflation, the Federal Reserve has taken decisive action in recent months. This includes raising interest rates multiple times and tapering its asset purchase programs. These measures aim to cool down the economy and bring inflation under control.

However, the Fed's actions are not without consequences. Higher interest rates can slow economic growth and potentially lead to a recession. There is also concern that aggressive rate hikes could trigger a sharp decline in asset prices, impacting investors and potentially destabilizing financial markets.

Investing in Times of Inflation: Strategies and Considerations

Navigating inflation requires careful planning and smart investment strategies. Here are some key considerations:

Diversify your portfolio: Don't put all your eggs in one basket. Spread your investments across different asset classes to reduce risk.

Consider inflation-hedging assets: Some assets, like real estate, commodities, and certain types of stocks, tend to perform well during inflationary periods.

Review your investment strategy: Consult with a financial advisor to ensure your portfolio is aligned with your goals and risk tolerance in the current inflationary environment.

The Future of Inflation: Predictions and Outlook

Predicting the future of inflation is challenging. However, several factors suggest that inflationary pressures may persist in the near term. These include ongoing supply chain disruptions, geopolitical tensions, and the potential for continued strong consumer demand.

The Federal Reserve's actions will play a crucial role in shaping the inflation outlook. Experts are closely monitoring the Fed's policy decisions and their impact on the economy.

Conclusion

Understanding the distinction between consumer inflation and asset inflation is crucial in today's economic environment. While both erode purchasing power, they manifest differently and require distinct strategies for mitigation. The Federal Reserve's actions to combat inflation have significant implications for consumers and investors alike. By staying informed and adapting to the changing landscape, individuals can navigate these challenging times and even potentially profit from asset inflation while protecting their financial well-being.